Sales Tax...

Pennsylvania has a flat 6% sales tax. Another 1% is added for purchases made in Allegheny County, bringing the total sales tax in the Pittsburgh region to 7%. You won't have to worry about this when grocery or clothes shopping, however; because these items are exempt. Pennsylvania has made a number of major items like food (not ready-to-eat), candy, gum, clothing, textbooks, computer services, pharmaceutical drugs, resale items, and residential heating fuels exempt from sales tax.

Income Tax...

Personal income tax is a flat 3.07% for Pennsylvania and another 3% for Pittsburgh residents. Earned income tax in Pittsburgh's surrounding suburbs varies by location, but is generally lower than Pittsburgh's 3%. You can find out exactly what your local earned income tax rate will be by entering your prospective home and work address in the PA's DCED search tool.

Property Tax...

Property tax is paid by home owners based upon the property location and assessed value. The equation that should be used to calculate your property tax obligation is:

Property Tax = ((Assessed Value) x (County Millage Rate + School Millage Rate + Municipality Millage Rate)) / 1000

The assessed value of all properties in Allegheny County are available at the county's real estate portal. Three separate millage rates must be combined when calculating your total tax obligation. The county, local municipality, and local school all tax property at separate millage rates. Your choice in location will have a significant impact on these values. The City of Pittsburgh provides an online property tax calculator to help residents understand their property tax obligations. Other calculators may exist, depending upon the municipality.

Allegheny County Millage Rate:

Allegheny County millage rate is a flat 4.73 for all county residents.

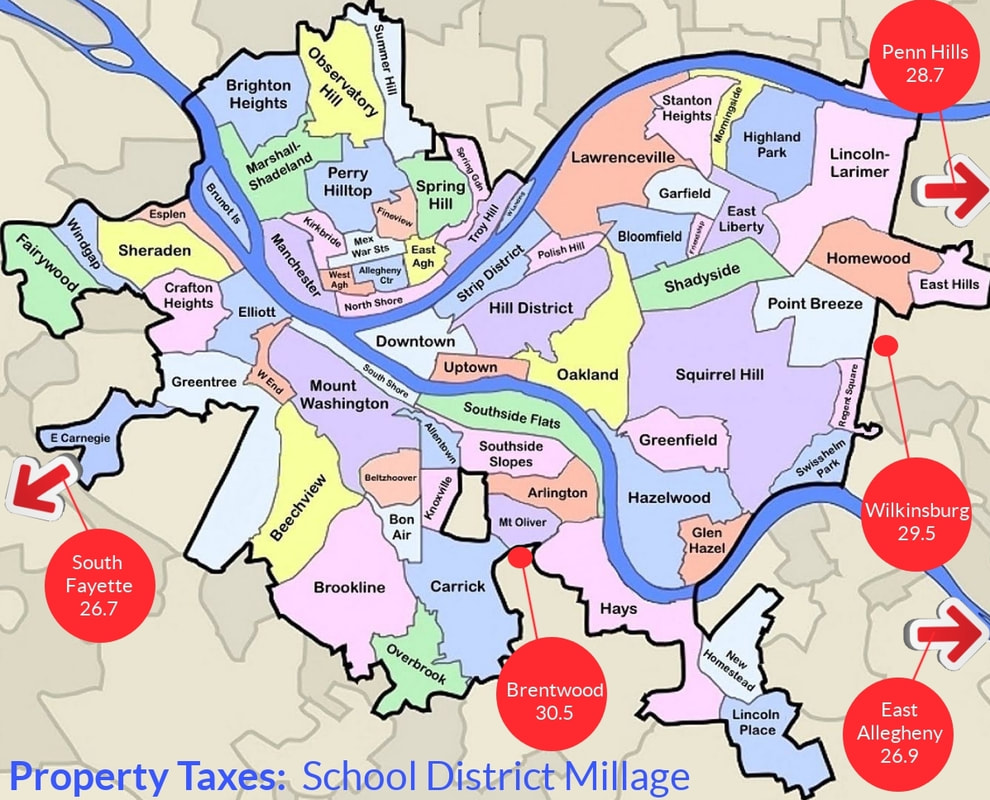

School District Millage Rate:

School district millage rates vary wildly throughout the Pittsburgh region. A complete listing is provided by the county. The image below shows locations with the highest millage rates. By comparison, Pittsburgh school district millage rate is 9.95.

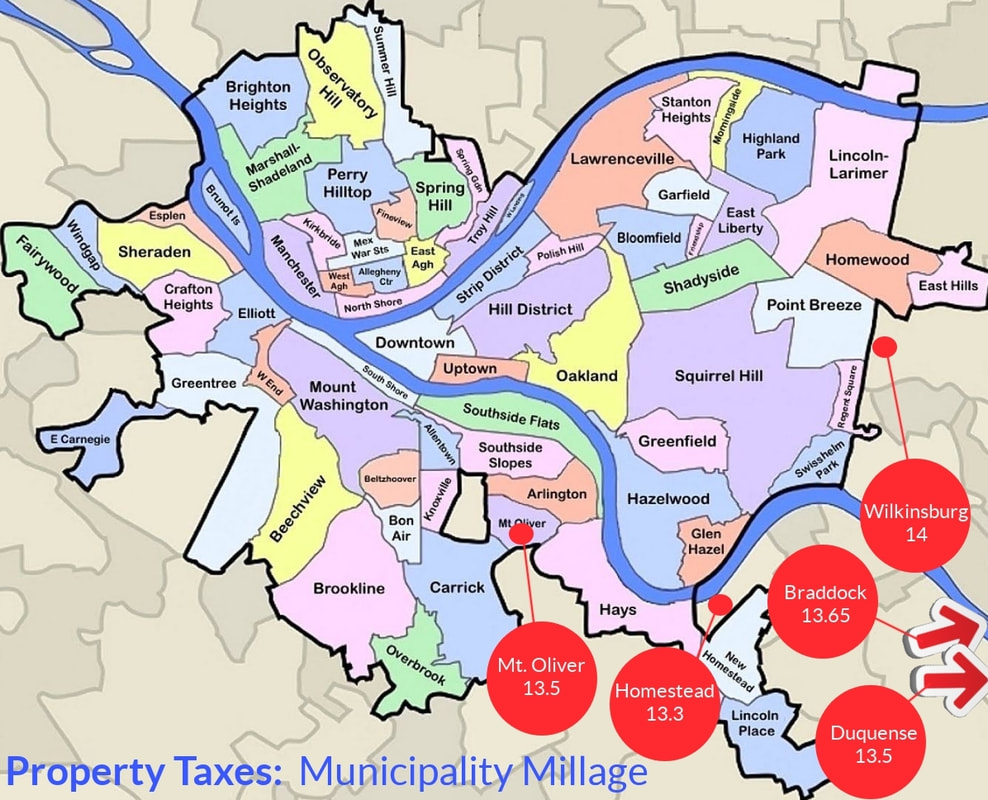

Local Municipality Millage Rate:

Local municipality millage rates can also vary wildly throughout the Pittsburgh region. A complete listing is provided by the county. The image below shows locations with the highest millage rates. By comparison, Pittsburgh municipality millage rate is 8.06.

Explore other Pittsburgh facts...

Furnished Home Rentals |

Support

|

Info |

Relocating to Pittsburgh |

© COPYRIGHT 2015. ALL RIGHTS RESERVED.

|